From my personal experience within the industry, I can attest to the importance of using metrics to measure performance in bidding. Whether I was working with a US multinational or with other successful organisations later in my career, using metrics was at the heart of our bidding success.

You have several obvious options to consider:

- Win rate: Percentage won over number of bids. This is still a key indicator for me though some might argue there’s more to it than the proposal (and surrounding activity). It’s really important to be objective with this and include all of your closed deals… so no entries of ‘no decision’ on your log (e.g., if the customers don’t tell you they’ve awarded the deal but have remained with their incumbent).

- Capture rate: Percentage of deal value won over deal value bid. This alternative to win rate provides a different perspective. The difference in numbers shows if you’re winning the bigger ticket deals or not and perhaps where your weaknesses are. Winning 27 deals in a row with a total of £290,000 revenue might give you a fab win rate but the loss of two £200,000 deals where you’re the incumbent could get glossed over.

- Proposal quality: I’ve seen this measured in two ways: capturing the customer’s quality scores in their feedback (where quantified) and through a post-submission internal peer review (where a score is based on key attributes such as strategy, messaging, structure, writing quality and design). Both ways show two versions of the same important measure.

- Bid price: Not as commonly tracked but would include tracking the customer’s pricing scores (where quantified). (This can often be reverse engineered to understand your competitor’s prices.) It is also occasionally used as a measure of actual against price-to-win estimates from the capture process.

- Proposal efficiency: This metric measures the team’s ability to deliver a high-quality proposal within a reasonable timeframe. More time should deliver higher quality but is this the case versus the volume of the submission. It’s also important to measure if your customers are giving you less time (on average) to bid.

- Cost of bidding: A very important view of bid costs as a total over a year and also at a deal level. For example, do your public sector deals cost a disproportional amount of time and money for a much lower value contract? Or why did a particular deal cost much more than one of the same value the month before?

- Return on investment (ROI): This measures the financial return generated by the proposal team’s efforts. ROI can be calculated by comparing the cost of preparing the proposal to the revenue generated from winning the contract. (The last time I worked this out for a bid team the ROI was +1,100% – so no one could argue the value the proposal team delivered).

Tracking these metrics provides an insight into the strengths and weaknesses of the team. It allows managers to spot trends, react and develop strategies for improving performance. But there’s more you can do. The other key metric to capture is qualification score.

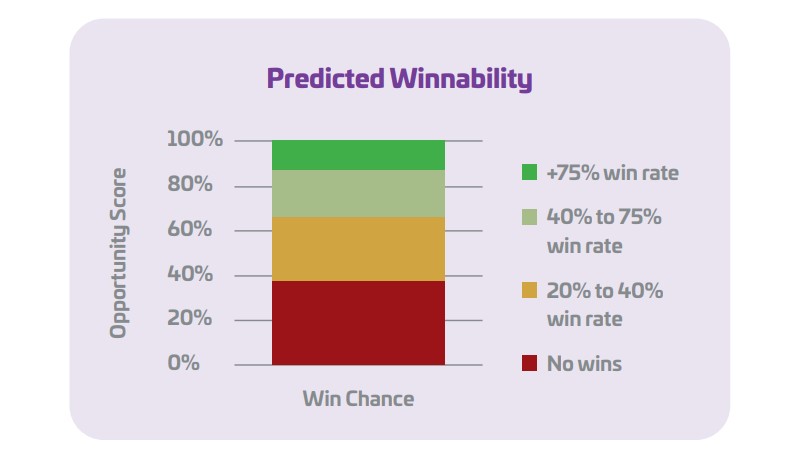

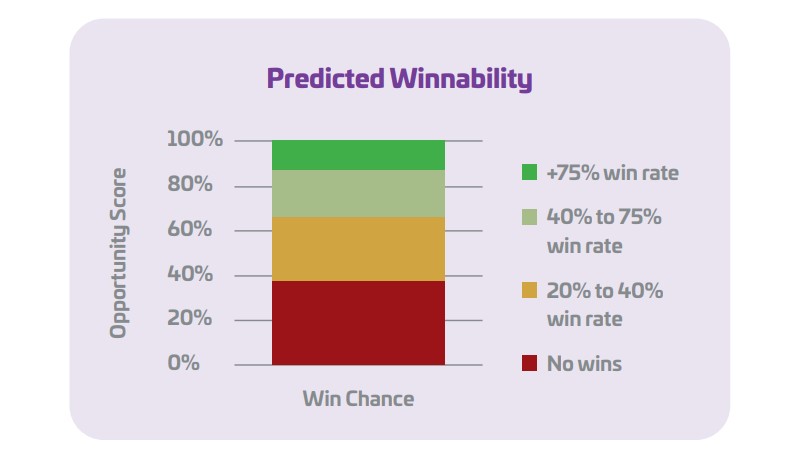

Let me tell you a story. A US multinational I worked with had a culture of bidding on everything. Qualification was a dirty word. And qualifying out was deemed against the winning culture of the organisation. As head of the bid team, I knew the opportunities we were supporting were not equally winnable (even though our win rate was north of 40%). We decided to use guerrilla tactics and developed a system of scoring each opportunity based on seven key questions to predict winnability. The team scored each opportunity for about six months (more than 100) until we had enough statistically significant data.

Using this rating scale, we created a picture similar to the example shown here. We were able to quickly identify the opportunities worth pursuing which provided a higher chance of success. We also determined the threshold below which we never won a deal (I still remember this as being 37%). We would save valuable resources if we ‘no bid’ those.

The most interesting outcome for the management team came by asking, “How many more wins would we get if we moved the resources from the ‘no hopers’ into the ‘low win chance’ bucket?” The question alone was enough to change the bidding culture of the company.

In another company we tracked results by score and also measured the type of opportunity, the service, and the strength of the relationship with our customers. This allowed us to better predict our chances of winning the bid. We noticed certain service lines consistently had a high win chance if the customer relationship was strong, regardless of whether it was a cold new business or hot retention.

On the other hand, some service lines were less successful, regardless of their score or the relationship. This more nuanced approach helped us qualify opportunities faster and also develop a better capture plan where we had time (i.e., what we could do before submission to improve our chances of winning).

Understanding the win chances by sector and type of opportunity was particularly illuminating. We could be highly strategic and prioritise efforts in sectors and opportunity types where we had a stronger track record. In contrast, we could reduce investment in areas where we weren’t competitive. This focus helped us allocate our resources more efficiently and increased our chances of success.

We used these metrics to develop a sophisticated and customised approach to bidding. By not solely relying on score, we could predict our chances of winning, improve our approach and increase our probability of a successful bid.

Metrics provide an analytical approach to performance measurement. They are essential for improving win chances – even if the current score is low. You should start using them now (if you are not already) to continually assess and significantly improve your success rates.

Graham Ablett

Graham Ablett is a Consulting Director at Strategic Proposals, where he helps clients to win specific opportunities as well as implementing effective and efficient proposal processes. He is a former board member of APMP in the UK, holding APMP Professional status, and is an APMP Approved Trainer.